Happy Wednesday, Reader!

If you were audited right now, would you be calm and ready or panicking and frantically going through paperwork?

Use these tips to help ensure your books are prepared

for an audit at any time!

Today's News:

|

|

Preparing for the future: The End of

Quickbooks Desktop

After May 31, 2024, QuickBooks Desktop 2021 software will discontinue your access to QuickBooks Desktop Payroll, Desktop Payments, live technical support, Online Backup, Online Banking, and other services. This also means you won't receive critical security updates protecting your data starting June 1, 2024.

It's time to make the move to Quickbooks Online.

|

Let's get back to that dirty "A" word.

Audit

Take special care when recording details about mileage, meals, or travel.

For meal expenses you are required to keep track of:

- Cost, date, name, address, busuiness purpose + relationship.

For travel expenses, you are required to keep track:

- Cost, date, destination, + business purpose.

For mileage expenses, you are required to keep track of:

- Date, beginning destination, ending destination, and business purpose.

By recording these details right when you categorize the transactions, you'll ensure you're prepared and ready for any auditor.

Your stored records should be organized

You need to keep all of your records for atleast four years and they should all be organized after you put each past year away.

Let's be honest, you're not going to remember the details of each transaction from 3 years ago, so before you file away last years financials, ensure each month is reconciled and every transaction has clear documentation. Putting them aside before they're 'audit-ready' will make being audited in the future so much worse.

Don't hide cash.

Certain industries are at higher risks of being audited, specifically due to the higher likelihood of receiving cash as payment.

Every business that deals with cash should have a separate asset account designed to track cash inflows and outflows. Cash activities should be accounted for no differently than bank account activities. Be smart and document all cash transactions.

Utilize Tools

The best way to be prepared for an audit is to have everything in the same place.

Use software like Quickbooks Online, to store receipts, record details for transactions, and have each transaction linked to your bank will help ensure your audit goes much smoother than manually going through a filing cabinet full of receipts.

General reminders to help prepare for an audit:

+ Never mix business and personal

+ Understand your sales tax obligations and file returns on time

+ Require W9’s for Independent Contractors

+ Use a payroll service

+ Understand what qualifies as a deductible

If you're unsure, lean on your bookkeeper.

My best selling service is our Quickbooks Clean Up, which allows me to dig in and find any mistakes. So, before you put away your 2023 taxes and books - consider a clean up to make sure you're ready for anything that comes your way in the future.

Close those books with peace of mind.

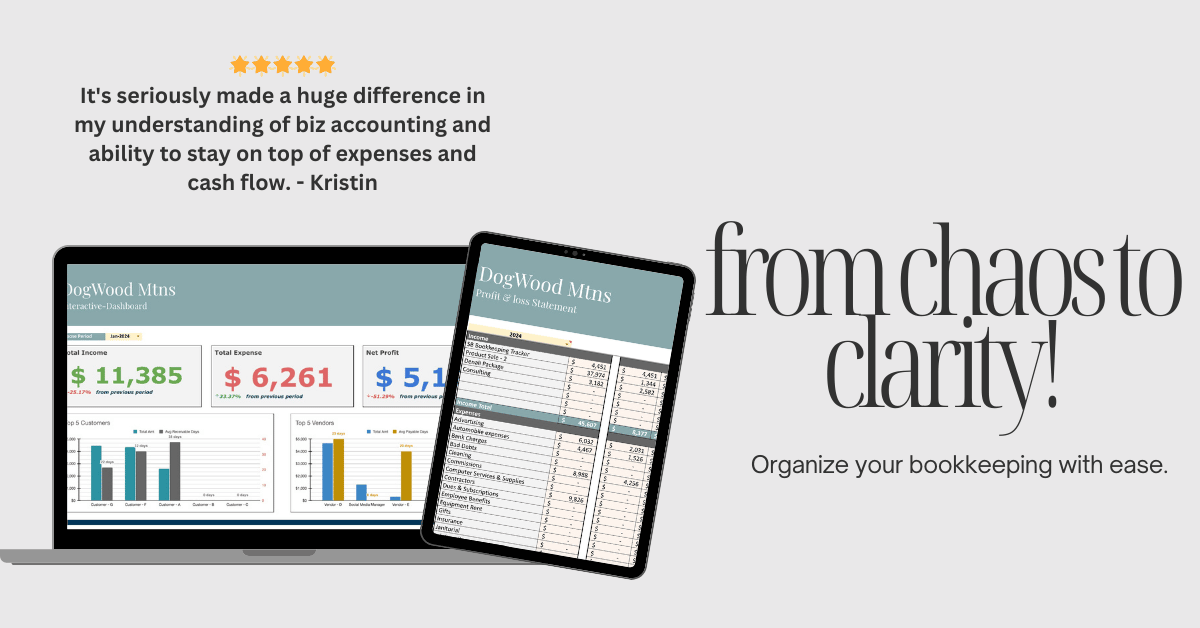

Not ready for help but need something to help you get your books organized? 👇

|

$47.00

Small Business Bookkeeping Tracker

Do you have endless piles of receipts to give to your CPA for taxes? Do you know how much profit you made for the month?... Read more |

Interested in a Clean Up Service?

👇 We've definitely got you covered.

Wow, this year is flying by.

Stay tuned for next month's newsletters - we're handing out our exclusive freebie to prepare you for your mid-year bookkeeping tasks!

– Amber